Recent news

Hire Purchase VS Leasing: Understanding the Key Differences and Tax Treatment

Improve Performance and Reduce Turnover

Tax Law Updates

Will the housing market collapse?

The below article from CAS Capitals debt insider newsletter, written by John Sheehan takes a deep dive into the Thailand property market and looks at what the impacts of Covid will be in the real estate and development sector. It also looks back to before the pandemic to get a feel for whether a quick recovery is possible, or if there are other underlying issues that will cause a deeper correction. All the opinions and facts listed below are the views of the author and are not a representation of Baker Tilly Thailand.

in the past year, property companies’ failings have been conveniently blamed on COVID. Underpinning this deception are huge stocks of unsold inventory and swathes of overpriced land that cannot be developed profitably. Bad judgement, errors, inexperience, myopia, and the fact that the real estate industry was in serious trouble well before the virus struck, have all been effortlessly swept under the COVID carpet.

Blaming just COVID, presupposes that as soon as the virus recedes, everything will be good again. In 2021 though, property companies are diversifying out of their core business. We see developers going into energy business, the NPL business, the health business; into anything else but property. This is a dangerous game. Entering a highly competitive industry without experience, is challenging in a good market. In a fragile global economy, where everybody else is in trouble, diversifying out of a core business is gambling with disaster. This is a time for hoarding cash, not recklessly gambling with alternative strategies. Radical actions like these, reveal a worrying lack of confidence in recovery amongst Thai property companies. Leveraged-backed expansion binges always collapse once markets correct. Credit-driven competition drove land prices above profitable levels years before COVID. If a project or hotel was unprofitable prior to COVID, trying to blame the shortfall on the virus now, with an expectation of a post COVID price rebound, is nonsensical.

COVID-a Short Term Blip?

The property industry has positioned the COVID crash as a short-term blip. The delusion is exhibited in real estate prices that are doggedly held up at artificially high prices. Discounting now is an admission that COVID is only the tip of a huge, end-of –cycle, iceberg. Property companies and banks know that a substantial reduction in valuation risks destroying their balance sheets, which would be terminal for some. No one therefore sees any value in owning up now and letting the market prevail. The only strategy left to pursue is inaction and procrastination- kicking the can down the road. The bank debt holiday that has been in place for the last year, is only effective if there is a brisk, strong market rebound. Everyone now knows that this is not going to happen, in which case, the debt holiday only amplifies the credit bubble problem. COVID downturn has not created pent-up demand. It has destroyed it, and the further the can is kicked, the longer and slower the recovery will be. This crash has the potential to be far worse than we could have imagined, capable of pushing the world into depression.

For now, the situation is contained by an eternal triangle of banks, developers and bond holders. Banks have liquidity, and no longer want depositor’s money. This leaves little earnings opportunity left for investors outside capital market gambling, or inbonds. Nearly all the current bond offerings are roll-overs of earlier maturing debts. In essence, kicking the can down the road again, which hopefully can be maintained, provided that the eternal triangle parties continue vested in holding together.

Developers, drowning in debt and sitting on dated, overpriced, inventory mountains, are chasing hope. Those that are not gambling in alternative strategies are hunting anything that resembles new demand. Developers stung by Purple Line oversupply are now pursuing opportunity in the new BTS Northern extension. However, regulations ensure that as soon as a new demand opportunity is uncovered, developers will oversupply it, turning it into another Purple Line fiasco for themselves, their bankers and any of their investors still reckless enough to take such risks.

The market is always king. We have reached the end of a 20-year bull run. Demand for property has dried up, and will remain so, until prices substantially correct, and market confidence reappears from the ashes of correction.

Betting Only on China?

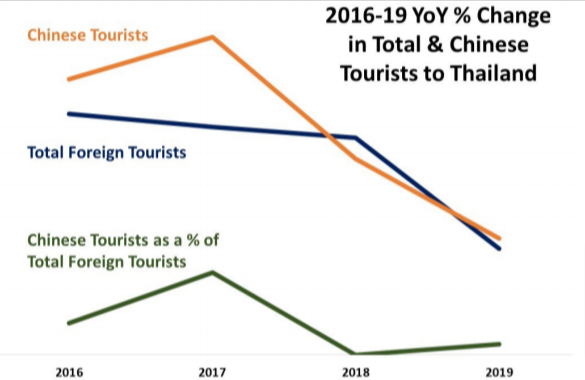

China is now the Thai property developer and hotel owners one-horse rescue bet. Their greatest hope is that a new wave of Chinese buyers will swallow up the condominium inventory mountain and Chinese tourists will flock back in their millions to flood Thai hotels. When and how this happens, remains to be seen. 2014 to 2017 were the peak years of Chinese visitor growth to Thailand. Pre COVID, Chinese visitor growth rate to Thailand was already declining by 2019, in parallel with the property market generally. Looking forward, post-COVID, foreign visitor reaction to unhealthy air quality, racked by dust pollution, will be a new negative unknown. Political upheaval and escalating military action throughout Asia is another dangerous tourism industry risk.

The recently announced hotel bail-out Asset Warehouse Fund is altruistic and well meaning but misses the biggest problems. These are: hotel room oversupply, declining quality, unprofitability, permit shortcuts and a lack of capex in existing stock. Extensive refurbishment and a reduction in room supply are needed to boost and maintain the hotel industry. Quantity over quality cheapens travel experience for both foreign tourists and the local population. The hotel industry would be better served by clamping down on Airbnb and rivals, raising standards and stiffening the Hotel Acts, to drive superior, sustainable, tourism quality.

Growth in receipts is the best indicator of success and should be a higher priority than tourist arrival numbers. Mass market tourism is dominated by tour operators that drive hard bargains at the expense of local hotel owners. Cheaper hotels employ fewer local people, so the local hotel industry and the local population are the ones that end up benefiting least from bottom-end tourism. Oversupply has not gone away. Continuing quality erosion will result in Thailand joining Cambodia, Laos, the Philippines, and Indonesia in the race to see who can drop rates furthest and provide the cheapest products that attract the lowest quality foreign tourists.

Chinese condo buyers started pulling back from Thailand in 2018, dramatically so in 2019. The rise and fall in buyer numbers was driven by unscrupulous Chinese brokers overpromising returns and capital growth, cheating their countrymen. China hates being made a fool of. Thai developers have understandably been sucked into the Chinese consumer backlash. The only Chinese buyers currently in play in Thailand are investors looking for distressed opportunity and bargains, that are mostly avoiding the condo market.

Given the scale of the Chinese market, it is inevitable that buyers will return to the Thai condo market. However, absent a new wave of crooked Chinese brokers colluding with local developers, sales volumes will only rebound when buyers are sure of achieving yield and capital value increases. Central to this, is a substantial reduction in property prices and an obvious, strong rebound and increase in demand for space.

By How Much should Prices Correct?

If correction is just a short-term blip, as banks and developers are now positioning for, prices may just stall, similar to what we saw after Asia realized that it had dodged the 2008 GFC bullet. If the correction is graver, which now looks most likely, then history shows a global, mean price-fall correction range of between 30% and 70%.

In the past year we have seen some developers cutting condo prices by between 30% and 50%, in order to clear inventory. Given the perilous state of most balance sheets, where debt already exceeds assets, this can only be undertaken on a very limited basis.

Furthermore, many developers have foreign, mostly Japanese, JV partners, which adds complication to price-cutting, clearance initiatives.

Condo owners have dropped rents by 50%, in order to let out space. Many have done so, just to part-cover CAM fees and subsidize loan repayments. Whilst this benefits domestic tenant affordability, condo yields have plummeted to between 0% and 2%. If a capex reserve is then added on, there is no yield. Why would anyone want to invest in condos again until prices have at least halved in line with lower rents and demand for space is thriving again?

Hotel values have plunged. Profitability will return, at best in 2023, meaning another two years of losses before stabilization. Current cost of capital is 15%., so a 30% loss needs to be factored in upfront. Add this to reboot, capex and renovation costs, and the sales price for some hotels, may be as much as a 40% reduction in price.

Over the past decade, many developers have diversified into leasehold acquisition as a means of avoiding nonprofit freehold land purchases. This makes sense in a boom market, but once correction occurs, selling leasehold becomes almost impossible, until freehold price inflation surges again. After 1997, it took the best part of ten years before the market accepted leasehold sales in volume again. Given the perilous state of global markets, it is inevitable that there will be no quickfix, rebound and recovery. Most players are choosing to sit things out and take their chances. Mass market foreign investment rarely favours local people. Foreign buyers fall outside local control, and risk driving up prices that are too expensive for the local market. Recovery is driven by the domestic market, where affordability and confidence are key. A market that functions solely for the benefit of foreigners and a few big local players, at the expense of the domestic population, is not sustainable, fails to solve the wider problem, and risks generating social and political discontent.