Grab IPO

The below article is by Yundyong Thantiviramanon, and is an opinion piece looking into the the food delivery arm of Grab and how profitable it is as a business. While Yundyong is an employee of Baker Tilly these are his personally opinions and do not represent the views or opinions of Baker Tilly Thailand.

With the upcoming IPO of GRAB, one aspect that we wanted to examine is the food delivery service they offer. We have talked to many small restaurants in Bangkok, and it’s no secret they are not happy with the GRAB food service. Their claim is that they don’t have the size to negotiate better rates (often paying up to 32% to Grab for their service), as well as the fact that Grab will force them to constantly do promotions. Similar claims are made around the world with other food delivery companies, but the fact remains that so far almost all of the current companies that have IPO'd have not been able to generate a profit on their food delivery arm.

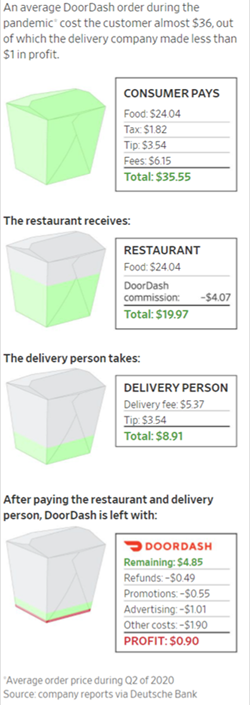

When looking at DoorDash, the numbers are quite astonishing. They generated 4 billion dollars USD in revenue in 2021 and are still yet to generate a profit. Looking back further, in 8 years of operations they have not had a single profitable year. it’s a similar story with the other major players around the world like Uber and Grub hub. In fact, in many companies the average loss per delivery increased in 2021 despite a surge in deliveries due to covid. So what’s going on? And can Grab buck this trend?

I know what your thinking, Grab is operating in Asia where they have access to cheaper labor (especially delivery drivers) so surely they can make it work. But even though Grab haven’t made their books public yet in an FAQ on their website they state in clear terms that they are losing money on each delivery. Here is their exact statement. "GrabFood is not profitable and we don't “earn” the full commission we receive. We use a large part of it to pay our delivery partners on top and above the delivery fees, they receive. This will allow the app ecosystem to run equivalently between merchants, drivers, and consumers"

So whats going on?

Grab Food has stated it should not be compared with the US and European models of the industry as it is a completely different market. In Europe they cite two main issues in their road to profitability.

- The cost of delivery drivers must be supplemented by the commission

- The average order sizes are just too small to generate enough commission.

Here lies the problem with Asia, the drivers are much cheaper but the average order size is also significantly less. Add to this, Grabs business model is to win customers by variety which means their platform has thousands of smaller street side vendors which offer extremely cheap food. This brings their average menu cost to well below its competitors like Food Panda.

Grab currently has a 50% market share in Thailand, but they are being beaten on price by Food Panda and have an increase in competition from new platforms like Robin Hood. Their market share has come through leveraging their huge user base and creating a much larger variety of food to their platform. But in order to increase or even maintain market share they will most likely need to rely on strategic acquisitions.

Western food delivery services have admitted that even optimizing all their processes will not lead to profits, and are targeting alcohol and grocery deliveries as the catalyst to profitably due to the higher average order costs. In Asia it is hard to imagine the large grocery chains giving up a 15% commission to grab when they have already rolled out their own delivery services. So while the orders may be larger, commissions will be lower and the problem is not solved. Food delivery is a very low margin business, and that will not change anytime soon. It is interesting to see though that the major delivery services in Thailand are now heavily promoting grocery delivery, which hints they may have come to the same conclusions about the road to profitability. In the end Grabs goal may not be to be hugely profitable, In essence the more users they can engage by downloading Grab the bigger boost that it will give to their other more profitable divisions.

There is one silver lining for Grab Food, and that is a company called Meituan. It is currently the only profitable food delivery service we know of, and it operates in China with a 65% market share. Grab believes that this is a more apt comparison for their business, although reaching the scale Meituan has will not be easy due to market size limitation. While Grab doesn’t have any access to the Chinese market, their SE Asian market does include India which offers similar scale potential. In the end this is a cost-intensive sector which will rely on scale to match the profitability of Meituan, and while they may get there it will most likely be a long and bumpy ride or simply a very expensive marketing campaign.

The information contained in the content (“Website Article”) posted represents the views and opinions of the original creators of such Content and does not necessarily represent the views or opinions of Baker Tilly Thailand. The mere appearance of Content on the Site does not constitute an endorsement by Baker Tilly Thailand or its affiliates of such Content.

Baker Tilly Thailand hereby disclaims any and all liability to any party for any direct, indirect, implied, punitive, special, incidental or other consequential damages arising directly or indirectly from any use of the Content, which is provided as is, and without warranties.